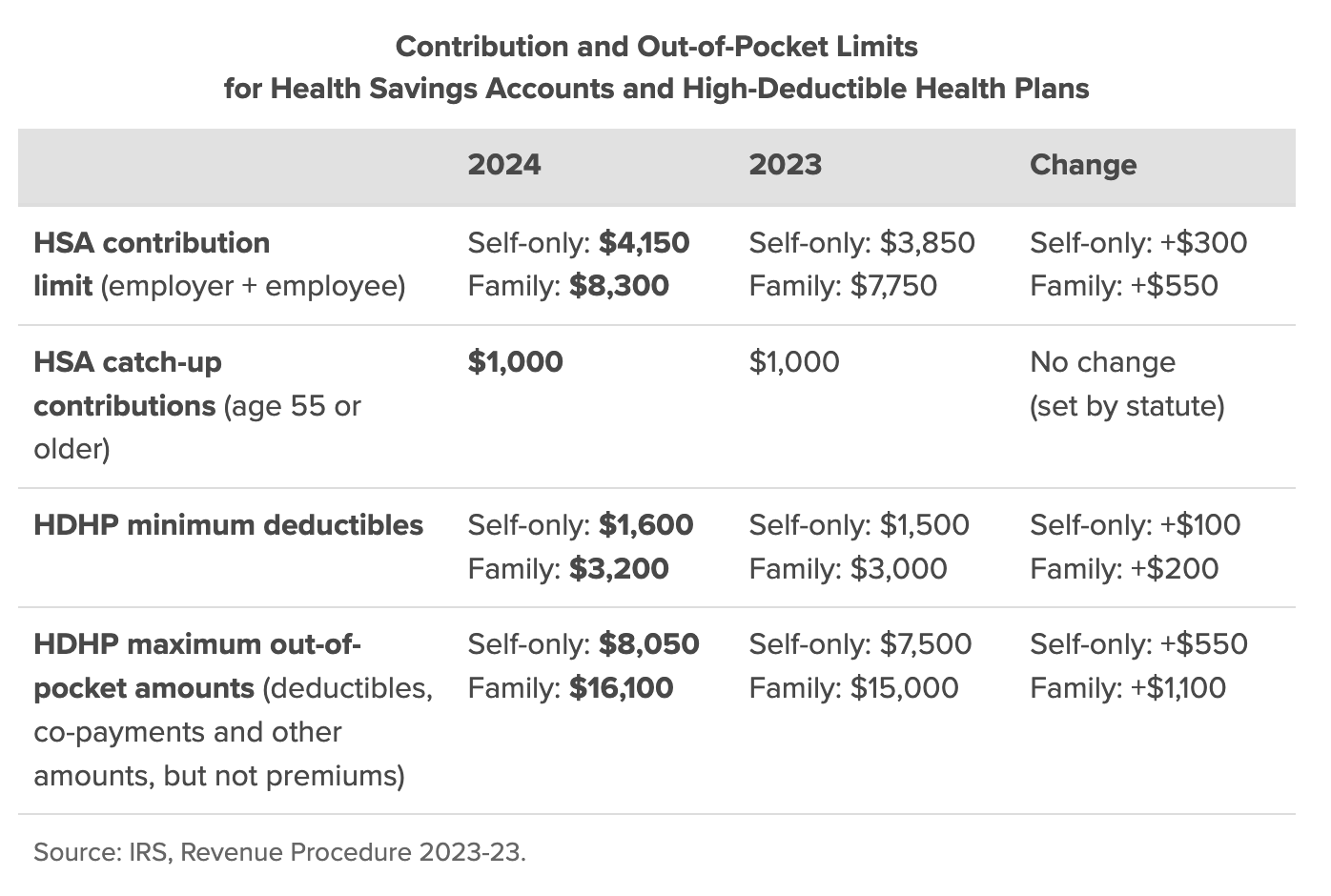

Irs Hsa Contribution Limits 2025. The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families. For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

The irs announced one of the most significant increases to the maximum health savings account contribution limits for 2025. Your contribution limit increases by $1,000 if you’re 55 or older.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, The irs annually evaluates limits and thresholds for various benefits and provides increases, as needed, to keep pace with inflation.

2025 HSA Contribution Limits Claremont Insurance Services, The irs states that contribution limits must be prorated by the number of months one is eligible to contribute to a health savings account.

Hsa Pre Tax Contribution Limits 2025 Tobye Leticia, The hsa contribution limit for family coverage is $8,300.

Hsa Max In 2025 Eryn Odilia, Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

2025 Annual Hsa Contribution Limits Cal Annabelle, For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

Significant HSA Contribution Limit Increase for 2025, Use this information as a reference, but please visit irs.gov for the latest updates.

Irs Hsa Limits 2025 Catch Up Rubi Wileen, The hsa contribution limit for family coverage is $8,300.

New HSA/HDHP Limits for 2025 Miller Johnson, The hsa contribution limits for 2025 are $4,150 for individuals and $8,300 for families.

IRS Announces 2025 HSA Contribution Limits, It’s important to know your plan deductible and limits before you enroll in an hsa, since these are the numbers that determine your eligibility.